What is a Factura? How is it used?

By Patricia Ann Talley, MBA, and Editor*

You may need a “factura” to recover medical expenses

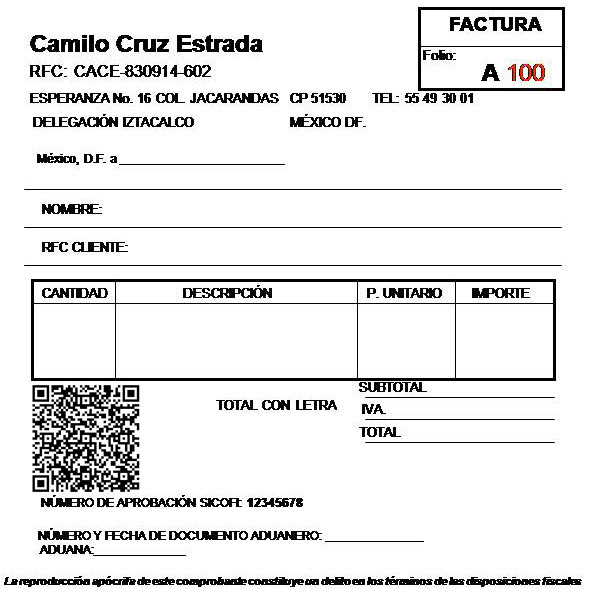

A “factura” is an official sales receipt issued and filed with the Mexican tax authority (SAT). Tourists or foreign residents may need to obtain a “factura” to get reimbursed by your home country insurance provider for medical expenses incurred in Mexico.

To obtain a “factura”, you will be asked for your “RFC” number (Federal Contributor Registry), which is your tax identification number that is issued by SAT (Servicio de Administración Tibutaria).

Tourists and Expats, who are not conducting business in Mexico and who are not registered with SAT, can obtain a “factura” for the reimbursement of medical expenses by giving the following generic RFC number for foreigners: XEXX010101000

You will need “facturas” to rent your property or to conduct business in Mexico

If you are a foreigner and you want to work, operate a business, sell products or services, or rent your property legally in Mexico without any problems, you must apply for a Temporary or Permanent Residency Visa for Lucrative Activities.

After obtaining your Temporary or Permanent Residency Visa from the Mexican Consul in your home country, you need to hire an accountant in Mexico and obtain an “R.F.C” number (Federal Contributor Registry) from SAT (Servicio de Administración Tibuutaria), which is your tax identification number. After you obtain the “R.F.C.”, you must return to the local Mexican Immigration Authority and apply for a Temporary or Permanent Residency Visa for Lucrative Activities.

The accountant will also help you obtain official tax invoices for your clients, called facturas. Facturas are issued electronically through SAT, which allows the government to track taxes that are due, including the value-added tax (IVA) on all goods and services.

My accountant generates facturas for me to issue to my business clients. You will also obtain facturas for all tax-deductible expenses. You can request a factura at the time of purchase, which can be emailed to you, or many companies issue them on their websites. Facturas must be issued during the month of the purchase unless it is indicated that receipt of payment may be made over time (account receivable).

Everything is done electronically. My accountant set everything up for me with SAT and automatically receives any factura that is issued to me for purchases. She also generates facturas for me to send to my clients for consulting fees. All I do is to send her a copy of my monthly bank statement so that she can prepare my monthly tax filing, which is due by the 17th of the following month. You need a good accountant!

Collecting Facturas to Deduct Business Expenses

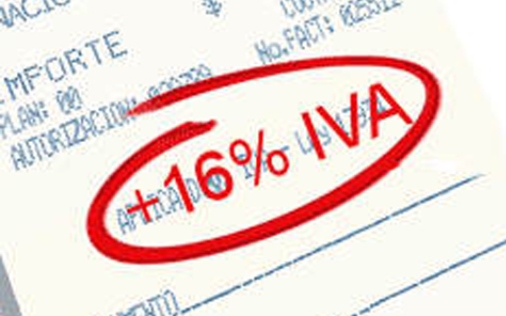

Mexico has “IVA” (Impuesto al Valor Agregado) which is an “added-value” tax that is applied to the purchase of all goods and services. It works like a sales tax. The current rate is 16%. You must have a factura to deduct any business expenses. Some businesses, especially small vendors, avoid this tax by issuing an unofficial receipt, called a “nota,” which is not tax-deductible.

You can look at your receipt from a Mexican supermarket and you will see the word “Impuesto” before the total, indicating the amount of IVA that was included in the price of your purchases.

IVA – Added Value Tax: How does it work?

Again, IVA is an “add-on” tax. When I first came to town, I asked for an appointment with the Controller of a resort hotel and volunteered to give him English lessons if he would teach me the “basics” about Mexican accounting. You do not need to speak Spanish to understand numbers! Here is a real “basic” overview of how IVA works.

You make a sale or collect vacation rental payments and “add-on” IVA: Sale Price: $6,000 pesos; IVA (16%) is $960 pesos for a Total of $6,960. You owe SAT $960 pesos, less IVA tax credits | You purchase items and ask for a factura. During the month, your purchases amount to $4,000 pesos, which includes IVA. Purchases: $4000 pesos; IVA tax (16%) that was added-on is $551 pesos (IVA tax credit); IVA tax due from sales is $960 less $551 IVA tax credit from purchases. You owe SAT $409 pesos (not $960) |

A common mistake that foreigners make who want to rent their properties when not in use, or who want to start some other type of business, is to start purchasing things BEFORE getting registered with SAT, and therefore, their business-related expenses cannot be deducted from their Mexican tax returns.

IVA “tax credits” can be carried-forward (accounting talk) to offset future income received. For example, I run my consulting service and publication business out of my home office. I ask for a factura for all expenses – my car, car repair, car and condo insurance, the furniture and decorations, appliances, utilities, computers, printers, office supplies, Netflix, Godaddy, groceries, etc. In this way, I accumulate IVA tax credits from these purchases that can be used to reduce (offset) the amount of IVA owed to SAT from future sales.

My Advice – Get a good accountant! A good attorney sets you up so that you will not get into trouble by operating a business in Mexico. But, a good accountant keeps you out of trouble!

*About the Author: Patricia Ann Talley holds a master’s degree in Strategic Marketing Planning from the University of Michigan, and a Bachelor of Science in Financial Investments & Accounting from California State University in Long Beach. A former marketing executive from Chicago, she has owned and operated businesses in Mexico for over 20 years and is a dual (American Mexican) citizen.

Related Articles: